Debt Relief for Bad Credit

Bad debt is debt that has gone unpaid for so long, there is little chance of it ever being collected. The creditor writes it off as a financial loss due to default, which is called a charge-off. The account is then closed, and the debt may be sold to a debt buyer or transferred to a collection agency. Creditors who are determined to collect their money sometimes take legal action.

When a credit card, loan or medical bill hangs in limbo for too long, it can also hurt your credit score. A charge-off on your credit report is a huge red flag. It shows anyone who checks your report that you have written off the debt and don’t intend to pay it back.

A delinquent account can come back to haunt you for years, especially if you want to get a loan or take out a new credit card. If you do get approved, you will pay a much higher interest rate because you are considered at high risk of defaulting. Even if you eventually do pay off the overdue debt, the charge-off will remain on your credit report for 7 years.

Your Credit Score Matters

If you have a history of not paying bills on time or owing too much money, creditors consider you a bad credit risk because there is a good chance you will default on future payments. On a scale of 300 to 850, your credit score probably falls below 580, which means you will have a harder time achieving financial milestones, such as being approved for an auto loan or mortgage. If you do somehow receive credit approval, the odds are that you will receive less favorable terms, such as high interest rates or annual fees. The most common causes of bad credit include late payment of bills, bankruptcy filing, charge-offs, and defaulting on loans.

When you make late payments or default on the payments altogether, the lender or creditor reports it to the credit bureaus. The information is included in the your credit report, which lenders and other creditors use to make decisions on whether or not you are a good candidate to pay back a loan.

Having a good credit score is important because it helps you borrow money at lower or 0% interest rates. For example, if you have excellent credit, you might qualify for a 0% APR credit card, which offers no-interest financing for an extended period of time. Using this type of card can save you money in interest and help you pay off your debt faster. In addition, you can avoid security deposits and pay lower down payments on some loans. This can free up some of your cash to put toward other financial goals and expenses.

When you add up all the savings in interest, a good credit score can save you thousands of dollars. If you are challenged with a bad credit score, you can take steps to improve it.

As mentioned before, a charge-off is a debt that has gone unpaid for so long, creditors have assigned it a bad debt status. When an account is charged-off, it is closed. The debt may then be sold to a debt buyer or transferred to a collection agency. Creditors sometimes handle things themselves by taking legal action.

When a creditor gives you a loan or line of credit, they do it in good faith and assume you are going to pay back what you borrow. If you fall behind or stop making payments altogether, your account can become delinquent.

Having a charge-off on a credit report doesn’t let you off the hook. You are still legally responsible for paying it. The only difference is that you now owe the money to the company that purchased your debt. The debt collector will usually act against you to recover the funds through phone calls, written requests, or even suing you in civil court.

What To Do When Bad Debts Get Charged Off

Hundreds of thousands of people have used debt relief to pay a lump sum that is less than the amount they owed.

If you choose to go this route, an expert will negotiate with creditors on your behalf to reduce your amount of debt. The next step is to set up affordable monthly payments for you to pay off the rest. You could see your accounts resolved in as little as 24-48 months. If you don’t have an income and saving money eludes you, you will not qualify for this method. But don’t worry, there are other options available for you to consider.

How Do Charged-Off Debts Affect Your Credit?

A significant part of your credit score is based on timely payments for loans, credit cards, and other types of credit.

Charge-offs are the enemy of credit scores. They can cause your score to drop drastically, especially if they are preceded by late payments. A lawsuit or judgment can deal another blow. Creditor judgments can linger on your credit reports for up to 7 years. And you are not off the hook just yet. A creditor can request the court to renew an unpaid judgment, which can keep that stain on your record even longer.

According to FICO, the most widely used credit scoring system, a charge-off can cut up to 150 points off your credit score. The higher your score before the charge-off, the greater the drop. This can have great repercussions since creditors use a FICO score to predict if you are a good candidate to borrow money and pay it back.

“From the first call, National Debt Relief wanted to help me and showed me how I can be successful and get debt free without being judgmental.”

The Average Credit Score in the US

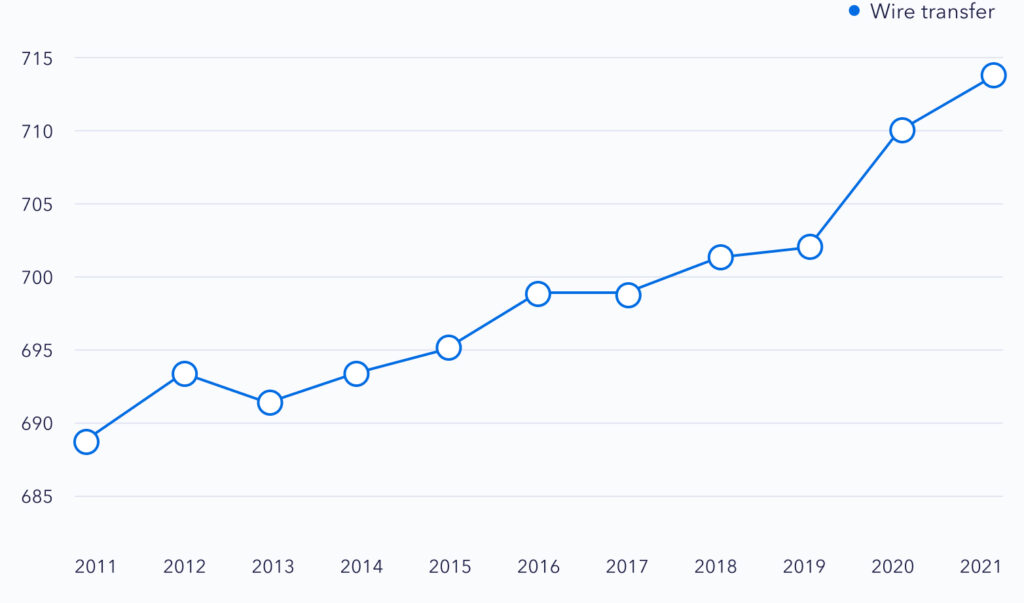

The average FICO score in the US in 2021 was 714, a 4-point increase from the previous year.

There is a bit of silver lining. Having a charged-off account listed as paid on your credit reports could undo some of the damage. And as your charge-off grows older and you remain up to date on all other payments, its impact lessens. A charge-off from a few years ago hurts your scores much less than a charge-off from last month. You can also recover your credit score by making on-time payments on all your other accounts.

How to remove a charge-off from your credit report

It may be possible to remove a charge-off from your credit report in under 7 years. After that, you can begin rebuilding your credit score and get on financially steadier footing. Follow these 4 steps:

- Determine the details of the debt

- Dispute inaccuracies

Gather information about the charge-off, including the amount owed, age of the debt, and who currently owns it.

1. According to federal law, you can initiate a dispute with a credit bureau you believe is reporting inaccurate information or is disputing something past the statute of limitations in your state. The credit bureau must investigate your claim and correct or remove any errors. This is called a debt validation.

You can request a debt validation by sending a letter to the collection agency. The Consumer Financial Protection Bureau (CFPB) has a template you can follow. Once you send the request, all collection efforts must temporarily stop until the debt collector is able to validate the debt.

- Negotiate with the creditor

- Hire a credit repair company

You can ask the creditor or debt collector to update or remove the charge-off from your credit file in exchange for a fee—which is called a “pay for delete.” If the debt is old, the creditor may be willing to accept less money than risk receiving nothing at all.

There is always a chance that a creditor will insist on receiving the full amount. You legally owe them the money so there is nothing more you can do except wait out the charge-off or pay what you owe if you have the funds.

Credit repair is when a credit repair organization or credit services organization attempts to get information removed from your credit file in exchange for payment. A credit repair company charges a fee and can’t do anything for you that you can’t do yourself.

- Settling charge-offs for less than you owe with debt settlement

- Seeking advice from a credit counselor

The goal of debt settlement is to convince the creditor to accept a lesser amount as settlement for the debt you owe. In exchange for partial payment, the creditor agrees to discharge the remaining balance. Once the settlement is accepted and completed, the balance will be updated to $0 on your credit report.

National Debt Relief can help you pay off your debt for significantly less and in a quicker amount of time. Call for a free, no-obligation consultation.

When you take the debt counseling route, a credit counselor will offer solutions for managing your debt. Their goal is to help you pay off your balances and avoid bankruptcy. In addition to your charge-offs, they can help you catch up on other payments if needed. A credit counselor can also help you map out a future without charge-offs and debt by reviewing your budget and revisiting your spending habits. Planning ahead is a proven strategy to avoid bad debt.

Yes, good debt exists. When you think about it, borrowing money is the only way most people can afford big-ticket items like a house. This type of debt is justifiable, can increase your net worth, enhance your life, and help you build up your credit score.

Examples of Good Debt

Student Loan Debt

Paying for education with student loans is one of the most common forms of good debt. Shaping your future through education is an important investment in your career and overall well-being. That is why student loans are considered good debt. They come with lower interest rates than other types of loans and the interest may be tax-deductible. Other benefits include:

- Some federal loans may be subsidized

- The interest is tax-deductible

- Most come with a variety of repayment plans

- Education sets people up for future success

- Small Business Expenses

- Mortgage Loans and Real Estate Investments

If your business provides a lucrative source of income, its investments are seen as good debts. Starting a business can temporarily hurt your bottom line. But if you spend your money wisely and have good business sense, you will be able to repay these debts over time.

Taking out a mortgage to pay for a house is also considered good debt. At the least, homes generally retain their value over time. If they appreciate, the additional money increases your net worth.

Making on-time payments is key to preserving your mortgage and avoiding bad debt. Setting up automatic payments does the work for you and leaves you with nothing to remember or forget. Avoiding reductions on your assets is another way to keep your debt in the positive.

Source: https://www.statista.com

How did bad credit impact your debt

| Answer | % of respondents |

|---|---|

| Could not get loans I needed | 59% |

| Loans were too expensive | 38% |

| Was not able to get a job due to credit | 7% |

| Was not able to rent an apartment due to credit | 30% |

| Other | 13% |

Examples Of Bad Debt

Bad debt reduces your net worth. As a rule of thumb, anything you can’t afford or make money from is considered bad debt. These include things that lose value over time and do not contribute to your income, like a car. They often come with high interest rates, costing you even more out of pocket.

Owing money on your credit card is one of the most common types of bad debt. Since credit cards charge some of the highest interest rates around‑ often 20% or more – it isn’t unusual to suddenly discover you are in over your head.

On the other hand, owning a credit card also has its good points. Credit cards are one of the quickest ways to build up credit, particularly if you are just starting out. Budgeting and curtailing spending can help keep your credit in good standing.

While it may be difficult to avoid taking on bad debts altogether, be aware of the most common types to determine whether it is worth the risk:

- Clothes and consumables

- Auto Loans

- Mileage

- Number of owners

- Service history

- Fuel economy

- Length of warranty

- Condition/wear and tear

- Personal Loans

- Consolidating debts

- Making investments

- Purchasing big-ticket items

- Travel

- Emergencies

Did you know that clothes are generally worth less than half of what you pay for them? Of course, you need clothing, food, furniture, and all kinds of other essentials. But using a high-interest credit card to purchase them isn’t a good use of debt. You can use a credit card for convenience, but make sure you can pay off your full balance at the end of the month to avoid interest charges. Otherwise, try to pay cash or put off making the purchase.

Most people need a car, so buying one might seem like a smart purchase. But auto loans are considered bad debt because the car’s value depreciates over time ‑ and as soon as you drive it off the lot. Your car depreciates due to changes in:

To avoid spending more than your budget permits, make the largest down payment possible. The more you put down, the lower your interest rate on the loan because you are borrowing less money.

If you aren’t careful, personal loans can get you into financial hot water. What you use the loans for will determine whether the debt is good or bad.

Personal loan interest rates range from 5-36%. A lender will check your credit score to determine the interest rate they charge you. This type of debt requires monthly payments to completely repay the loan within 2-5 years.

Personal loans can be used for many reasons, including:

- High Interest Loans

- Payday Loans

- Loan Shark Deals

Predatory loans are geared to consumers who lack legitimate alternatives. The lender charges extraordinarily high interest because they know you have no other option, or you lack the financial knowledge to understand the consequences.

These lenders mislead borrowers by enticing them to take out loans they are unable to pay back or must pay back at an extraordinarily high cost.

In general, stand clear of these types of loans:

Payday loans are a short-term, high-cost loan for generally $500 or less. Their name derives from the fact that they are typically due on your next payday. You could pay rates as high as 400%. With costs this astronomical, a payday loan should only be used as a very last resort.

A loan shark is a person who offers loans at high interest rates well above the legal standard, has strict terms, and generally operates outside of the law. You may be required to pay back these loans within a short period of time. Like the name implies, loan shark lenders are dangerous and should be avoided no matter how much you need the money.

Some causes of bad debt are outside of your control, like expensive life events including having children or moving to a new home. Other reasons like poor money management or consistently late payments can remain within your control if you practice spending discipline.

Here are some of the more common causes of debt:

- Lacking a budget

- Living beyond your means

- Low income or underemployment

- Lack of an emergency fund or savings

- Breaking up

- Higher cost of living

- Spending more than you can afford

- Declining health and medical expenses

Not having a budget is one of the simplest causes of debt. By not knowing how much money is coming in and going out each month, you could be prone to overspending. A monthly budget could go a long way toward helping you cover the essentials and showing you how much is left over to spend on everything else.

When you spend beyond your means, it is only a matter of time before the late fees catch up with you. Even credit card reward programs can be detrimental if you don’t pay in full every month. In this instance, the interest charges may cost more than the value of your rewards, which defeats the purpose. Cutting costs is a great first step to lowering your monthly expenses and living a life you can afford.

People who earn a lower income have less money to work with every month. So, paying bills or putting money into savings could be an insurmountable goal. The biggest risk to living paycheck to paycheck is not having the means to cover an emergency expense like replacing a dead car battery.

Saving money isn’t always easy, especially when you are struggling with debt or your earnings don’t provide much leeway. That is why an emergency fund is a must-have. If you save the suggested three to six months’ worth of expenses, you can avoid a dire situation if something like an unexpected medical bill throws a wrench in your budget.

Medical emergencies, major auto repairs and large home repairs can place your finances in turmoil for months or even years. By having an emergency fund, you will have a financial resource to turn to when you are faced with the unexpected.

When two people in the same household work, they bring in a dual income. But after a break up, your earnings could be reduced by half. And if you have legal expenses, you are going to need extra funds in addition to paying your regular bills.

This is a good time to take your financial inventory and determine if you need a side gig to bring in more earnings. You could also consider downsizing to a smaller place, shopping less, or cutting non-essential expenses.

Some parts of the country are more expensive to live in, like Chicago and New York City. Paying a higher price for a house, transportation, and even everyday essentials can affect your budget. Make sure you can cover the essentials before moving to a high-cost area.

Credit cards entice impulse shopping for a reason. You see something you want, purchase it on credit and figure out how to pay for it later. But when the credit card bill comes due, you might not have the funds to pay the balance in full. This is where the trouble starts, especially if it isn’t an isolated event.

If you are already paying the minimums or have defaulted on your credit cards, debt consolidation can make it more manageable to pay off. National Debt Relief can explain all your debt relief options and help you choose the one that is right for you.

Healthcare costs can add up quickly, even if you have insurance. In fact, declining health and medical expenses are a common cause of debt. If you are facing overwhelming medical costs, you can try to negotiate the amount you owe, work out a repayment plan or hire a billing advocate.

- Job loss

- Parenthood

- Closed for business

A regular salary provides comfort and security that you can cover your monthly expenses. If you can’t work for any reason, you will be responsible for the same monthly expenses but have no way to pay them. Using a credit card or debt services to cover your costs should never be your go-to option.

This type of situation is why having an emergency fund is essential. While the size of it will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months’ worth of expenses.

It is a well-known fact that having children is expensive. From childcare costs to extracurricular activities and higher education, providing everything they need quickly adds up. If you are having trouble making ends meet, debt relief could help you pay off your debt. Some companies also provide budgeting tips for a financially healthier future.

National Debt Relief provides a supportive debt relief plan that can help you become debt free sooner, and for less money.

Starting your own business can be a touch and go venture. If your business concept doesn’t take off, you could find yourself in debt. As the business owner, you are responsible to pay it all off – even if the business is closed.

Determining which debt relief option could be right for you will be a lot easier if you fully understand how each one works.

Credit card debt settlement

(Debt relief and debt settlement are interchangeable)

A company negotiates with each creditor on your behalf to reduce the amount you owe. In exchange, you agree to immediately pay off the rest of the debt. Don’t be surprised if you save 50% or sometimes more:

- Pay a fraction of what you owe

- Save with a lower monthly payment

- Resolve your debt faster than if you tried negotiating on your own

For example, a $10,000 outstanding balance is negotiated down to $5,000. In return for this one-time payment, the creditor agrees to forgive the $5,000 you still owe.

Participation in this program requires you to set aside a specific amount of money every month. The funds are deposited into an escrow-like account to pay off creditors after a settlement. Clients are instructed to stop making any monthly payments to creditors to prove hardship.

To qualify for debt relief, you must:

- Owe a minimum of $10,000 in unsecured debt

- Have the financial ability to meet monthly payments

- Be behind on credit card bills or other loan payments

- Be willing to stop paying your creditors and default on your loans (This helps you prove hardship and get a better deal)

- Have tried to manage the debt on your own, but haven’t gotten very far

- Have contemplated filing bankruptcy

Debt relief may not work for you if you are:

- Continuing to add to your debt balances

- Not interested in making a long-term commitment to repaying your debt

Debt consolidation loan

If you are already struggling with debt, a debt consolidation loan can help you pay it off for less money. With this type of loan, multiple unsecured debts are combined into a single new loan. This makes your monthly payments more manageable because they are all combined into one. A minimum credit score of 670 is required to qualify for debt consolidation.

These loans are only effective if the interest rate on the new loan is lower than the average of your current debts. Never use the money for anything but its intended purpose—to pay off your debts.

Save time and Money:

- Reduce high-interest debt

- Make your debt easier to manage

- Save with a lower monthly payment

To qualify for debt consolidation, you must:

- Provide proof of income to show you can meet your monthly payments

- Have a good credit history and credit report

- Show that you are a good financial risk

Debt management

This structured repayment plan is typically administered by a nonprofit credit counseling agency. The first step is thoroughly going over your financial situation with a credit counselor. They will then notify each creditor of your debt management plan and that they are now the payer on your account.

The counselor may seek concessions from each creditor, which can include lower interest rates, lower monthly payments, or “re-aging” an account to stop late fees.

Each month, your payment will go electronically to the counseling agency, which then pays your creditors. Be prepared to live without credit cards for as long as you are in the program.

To qualify for debt management, you must:

- Earn enough money to afford your expenses and the monthly payment

- Not earn too much money that enables you to pay off the debt on your own

The difference between debt management and debt settlement

Credit counseling organizations are usually non-profits that advise you on managing your money and debts. They often offer free educational materials and workshops.

Debt settlement companies arrange settlements of your debts with creditors or debt collectors for a fee. National Debt Relief can help you pay off your debt and remain debt free by offering financial tips and advice for future spending.

Bankruptcy

When you mention bankruptcy, it brings up all kinds of connotations and stigmas. But for some people, this is their best or only option. After you file for bankruptcy, your debt is forgiven under protection from a federal court. Chapter 7 bankruptcy erases most debts in three to six months without you needing to repay the debt or liquidate your assets. The downside is that it tarnishes your credit for up to 10 years, which is a great deterrent if you need a loan down the line.

Suggestions for an easier debt-paying process

If you owe money, it is important to pay it back as soon as possible. But sometimes, there is no way to cover the debt without digging your financial situation into a deeper hole. Managing your repayments wisely can help you pay it off faster and save you money in the process:

- Prioritize payments

- Prioritize your life

- Plan a budget

- Preserve your cash

Keeping up with your mortgage payments, rent and utility bills should be your top priority. Then you can start paying off your highest-interest loan first to save the most money in the end.

Paying off debt often calls for sacrifice. If you go out to eat often, start saving expensive meals for special occasions. And becoming debt free is more important than taking a trip. You can use a future trip as inspiration to get over the debt-free finish line.

It is important to know how much money is going in and the amount going out every month. That way, you can see how much you have to spend after covering the essentials.

Tracking your finances is important for you to pay bills on time. Setting up automatic payments is a great way to avoid late fees. Keeping an eye on your spending can also help you proactively curtail purchases that are in danger of putting you over budget.

During your free consultation, a debt specialist will determine a timeline and your monthly payment amount to settle your debts. You will immediately begin depositing that monthly payment into an FDIC-insured dedicated savings account in your name. Most clients become debt free in as little as 24-48 months.

Once a debt has been settled, we will contact you for approval and ask that you release the funds. If you lack the money to settle all your debts, we offer a payment program that enables you to make just one monthly payment to National Debt Relief. As the funds build up, we use the money to pay your creditors.

National Debt Relief is accredited with an A+ rating by the Better Business Bureau and belongs to the American Association for Debt Resolution — the watchdog of the debt settlement business. To be a member of this council, we have pledged to treat our clients with transparency, honesty, ethics, and fairness.

To learn more about how National Debt Relief can help you take back your life, call 800-300-9550 or complete the no-obligation debt consultation form today. We promise to support you every step of the way, just like we have done for over 500,000 people across the country.

At the core of our client relationships is one simple factor: trust. We know that trusting anyone with your finances takes a leap of faith, and we live up to your expectations by providing our undivided attention. That way, we can better identify your goals and concerns before customizing an affordable plan that can save you the most money.

National Debt Relief is the first debt settlement company to be accredited by the Better Business Bureau with an A+ rating, the American Association for Debt Resolution, the Internal Association of Professional Debt Arbitrators, and rated #1 on Consumer Affairs. We are proud to be the country’s only debt relief provider to enjoy recognition from these three important organizations.

Our Commitment To Customer Care Leads The Industry

We will always act in your best interest and our reviews reflects that promise:

- Over 75,000 5-star reviews from clients who have taken back control of their finances

- 4.83 out of 5 rating on TrustPilot

- Rated #1 for debt consolidation by:

- What happens if I ignore credit card debt?

- What is a good credit score?

- Always pay your bills

- Pay off debt as quickly as possible

- Keep your credit card balance below its limit

- Try to avoid applying for new credit

- Regularly check your credit reports

- How long does negative information remain on my credit report?

- What if my debt is old?

When you stop making credit card payments, you could be charged late fees and higher penalty interest rates. Not paying will also hurt your credit score. When your balance remains unpaid for a long amount of time and goes to collections, you could be served with a debt collection lawsuit.

If you ignore the lawsuit, a court will likely enter a default judgment that allows the debt collector to garnish your wages. To avoid this unnecessary hassle, it is important that you respond to the debt collector and/or debt collection lawsuit immediately.

Credit scores range from 300 to 850 and help creditors decide if you are a good lending risk. A high score tells them you are likely to pay back the loan. A low score is a telltale sign that you may be at high risk for defaulting on the loan.

Lenders have varying guidelines about credit scores. But in general, a score of 720 or above will receive the best interest rates and lowest fees.

Ways to keep a good credit score:

Most negative information, like late payments or defaulting on a loan, stays on your credit report for seven years. But certain information like bankruptcy could remain for up to 10 years. A lawsuit or unpaid judgment against you stays on your report until the statute of limitations runs out or for seven years, whichever is longer.

Debt collectors are held to the statute of limitations, which means they have a limited amount of time to sue you to collect on a debt. The countdown usually begins when you miss a payment or default. After the statute of limitations runs out, your unpaid debt is considered expired, and the creditor can no longer sue.

How long the statute of limitations lasts depends on what kind of debt it is and the law in your state — or the state specified in your credit agreement.

When you fail to pay a debt for a long period of time, it will eventually go into default. If the lender throws in the towel on collecting your debt, they may move it to a business loss on their accounting ledgers. This is called a charge-off, which is commonly reported to credit bureaus.

Debts that have gone into default can be sold to debt collectors or collection agencies, who will try to collect the money for pennies on the dollar. These accounts are known as “collections.” Collections are commonly reported to the credit bureaus. Charge-offs are viewed as worse to creditors than collections because you have less negotiating power to get them removed.

Something really exciting happens after people have their first phone call with us.

They immediately feel a sense of relief knowing they have a plan to get out of debt.

Pay off your credit card debt

- Receive A Free Savings Estimate Today

- See How Quickly You Can Be Debt Free

- No Fees Until Your Accounts Are Settled