The holidays are approaching and for many of us it’s a time for family and friends to express thanks and gratitude. It’s also retailers last push before the end of year to capitalize on profits. Consumers are bombarded with commercials, pop up ads, emails, and mailers all promising the best prices of the year with the objective of creating FOMO (fear of missing out) on the lowest deals.

This year many have felt the pinch of inflation, who hasn’t seen the uproar about the price of eggs? While the price has been easing down since February, eggs are still priced 36% higher than they were a year ago according to the USDA. Consumers are also used to higher prices, and this leaves an opportunity for retailers to increase prices and bank on increased cost being attributed to inflation costs versus elevated prices beyond inflation.

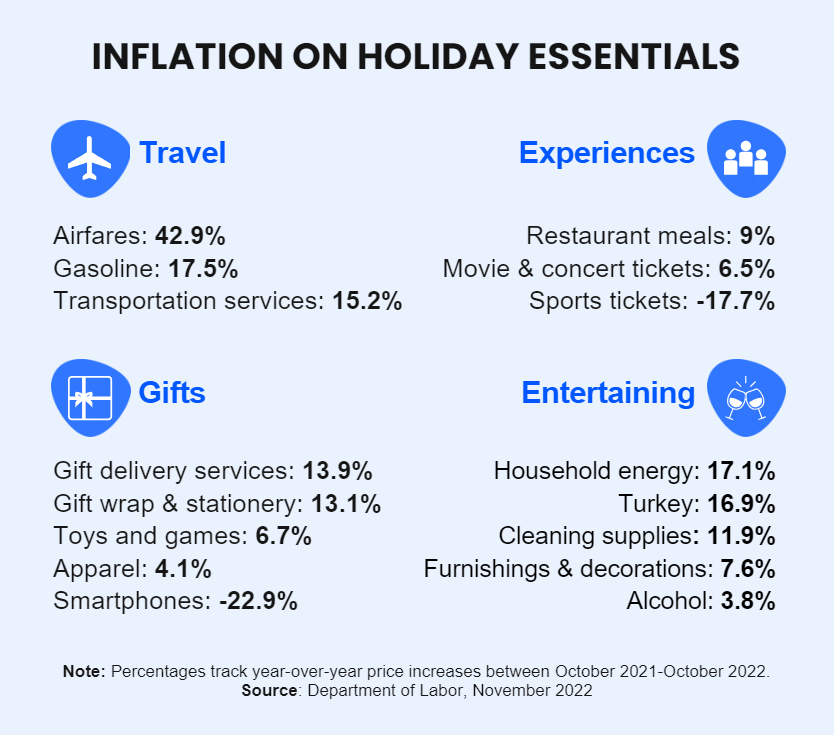

This holiday season may add a significant amount of stress to consumers who are already struggling with inflated prices. According to a new Bankrate study the costs of shipping a gift is up 13.9% and the department of labor reports Airfare up by 42.9%, Household energy up 17.2%, and that thanksgiving turkey will cost 16.9% more this year.

Maintaining a home, traveling for the holidays, and having family dinners will eat into gift giving budgets. Many consumers may find they need to cut back or will use debt to cover the cost to keep up the traditions of the holidays.

Source: Bankrate

Holiday Happiness On A Budget

At National Debt Relief we love the holiday season and understand that financial wellness includes having the freedom to enjoy friends and family without the fear of overwhelming debt. The first thing to do is set an affordable holiday budget, the earlier the better. You might exchange travel cost for zoom visits and virtual games with family and friends.

Another way to save is to use coupons when online shopping there are several plugins that do all the work for you to find the very best discount. Something we should all do more freely is discuss our budgets with our loved ones to set the right expectations, all too often we want to impress at the expense of what we can actually afford.

Aim for more thoughtful gifts like personalized framed poetry, a collection of memories in a handmade box, games that foster interaction with others on gift giving day; think out of the box but not out of budget.

A fun thing my family loves to do is gag gifts (think a bottle of blinker fluid for one’s automobile), it’s become a hilarious tradition that we will all remember over the individual items purchased. We still get the joy and laughter when unwrapping silly gifts and it adds a light heartiness to the season.

The Gift Of Financial Independence

For those struggling with debt, now is time to reach out for help, at National Debt Relief we have saved our clients over a billion dollars in debt costs. We tailor our plans to our clients, and it all starts with a free consultation. Many of our clients who join at this time of year are relieved that they can cut their expenses and still have a joyous holiday season without adding to their debt burden.

We always have our client’s best interest at heart, and that includes our understanding of family and traditions. We firmly believe our clients deserve financial freedom and it is our mission to support them all the way.