These days, commercials for free credit reports with credit scores are everywhere. You can’t turn on your television without someone telling you that you need to get your score right now. What is a credit score? Where does it come from?

Your credit report, which is a compilation of your credit history, plays a large role in your credit score. It includes things such as which credit cards and/or loans you have, your payment history for these accounts (and even rent), as well as negative items such as liens, charge-offs, and bankruptcies.

Your credit report is just that, a reporting of your credit history. Your credit score, on the other hand, is different. Your score takes all of the reported information and makes a judgment as to the likelihood that you will pay your bills on time. It tells creditors what kind of risk it would be taking by lending you money. The lower your score, the higher the risk is for them.

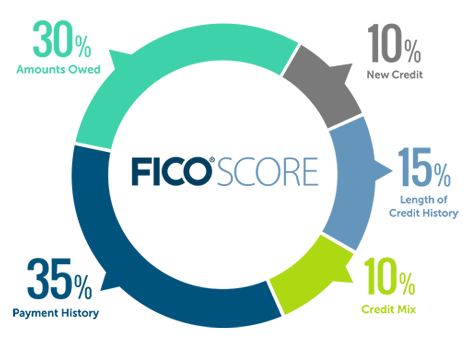

The most used credit-scoring model is FICO (from Fair Isaac Corporation). It has a range from 300 to 850, with higher being better. Although they don’t disclose how they calculate your score, they do say how much they consider each item.

Your Payment History is the most important. Your creditors will report payments as late if they are more than 30 days past their due dates. Not making payments to a creditor on time can result in hefty late fees, and you may be at risk of a higher interest rate.

The second most important aspect of your credit is your Amount Owed, otherwise known as your “Utilization Ratio.” The closer your balance is to your limit, the more likely you are to miss a payment, in theory.

Your Length of History is the length of time you’ve had each account and the length of time it’s been since you last used the account. When you get a new card, you may be tempted to cut up your old one, but this may not be the best thing for your credit score. Keeping your old cards and using them every now and then will give you a longer credit history and help your score.

New Credit is a consideration because customers who have opened numerous new accounts recently are riskier, for obvious reasons. If you feel the need to have several credit cards, open them over time instead of all at once.

Your Types of Credit Used is a consideration because creditors are looking for customers who can handle paying different types of credit in a responsible manner.

Depending on what type of credit you’re applying for, your lender may look at other factors as well in determining your creditworthiness, such as your current income and length of time working for your current employer.

Why are credit scores so important?

Creditors want to lend you money, but it’s a risk for them. They use credit scores to mitigate that risk. If your score is low, your lender may still lend you money, but it may charge you a higher interest rate to cover the costs if you default. For example, if you have a FICO score between 720 and 850 (excellent) and you receive a 48-month auto loan, you may qualify for a rate of 3.336%, which would be a payment of $223/month with $696 in total interest paid. The same loan for someone with a poor credit score of 590-619 would have interest set at 14.312%, for $275/month and a whopping $3,192 in interest over the life of the loan. MyFICO has a handy calculator that helps illustrate how much money a higher FICO score can save you.

You may not be applying for a loan or a credit card anytime in the near future, but it’s important to keep your credit score high by making payments on time and keeping your balances in check. When you do apply for a loan and you get that low-interest rate, you’ll be happy you did!