You might not think that dealing with your debt is an emergency situation. The perceived urgency of paying off debt has greatly diminished over the years due to how common it is for individuals to have thousands of dollars in credit card debt, student loans, and personal loans. When they go into debt, individuals often don’t make any of the necessary changes to their spending habits. But there are huge benefits to dealing with your debt sooner rather than later – and potentially disastrous consequences for leaving them unpaid.

While using loans to finance your education or improve your earning potential can be a wise long-term strategy, it’s dangerous to accrue large amounts of debt without a concrete plan to pay it off. The process of getting out of debt requires organization and disciple, but it’s certainly worth it in the end.

Paying off your outstanding debt can enrich the quality of your life in more ways than one. In an effort to help you gain a new perspective on why dealing with your debt is an emergency situation, we’ve created a list of advantages to paying it off as soon as possible.

Advantages to Dealing With Your Debt Immediately

1. Reduces overall interest accrued

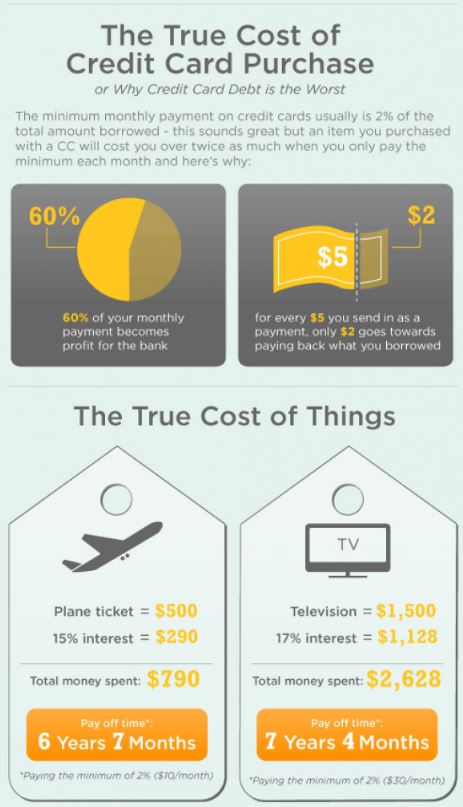

Accrual of interest is one of the most pressing reasons for paying off your debts as soon as possible. For example, if you have a credit card with a high interest rate, making minimum payments will only prolong your debt repayment process and cost you more money in the long term. Strive to contribute as much as possible each month to counteract this risk. If you’re struggling to come up with the money to do this, try reevaluating your budget or pick up some freelancing work on the side to earn extra cash. Treating your debt like it’s an urgent matter will help you pay the amount off quicker and ultimately save you more money.

Image sourced from infographicsmania.

2. Helps improve your credit score eventually

Being in debt can negatively impact your credit score. Approximately 30% of a credit score is made up of the amount of money you owe to a lender. This means that when you have large amounts of credit card debt outstanding in comparison to your credit limit, your credit score is going to be negatively affected. Focusing on getting out of debt is an extremely important first step in repairing your credit score. Many debt relief programs will temporarily affect credit scores as well, but it’s important to understand that the negative effects of these programs are temporary and nothing in comparison with continuing to struggle in debt.

CLICK HERE TO SEE IF YOU QUALIFY FOR A UNIQUE DEBT RELIEF PROGRAM.

3. Allows you to gain financial stability

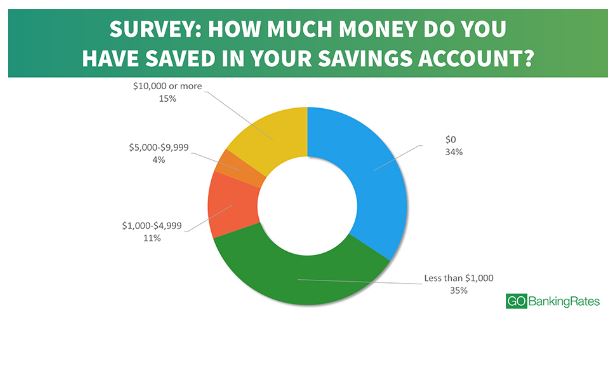

Being in debt can pose a major risk for you and your family if an emergency were to occur. When you’re in debt and choose to put it on the back burner, you’re sacrificing the peace of mind that comes along with financial stability and the ability to prepare for emergency situations in the future. No one can anticipate an accident or illness, but you can make sure you’re ready should it happen.

Image sourced from CNBC.

4. Promotes a healthier lifestyle

People often don’t realize how severe the impact of debt is on their physical and mental health. The constant stress of trying to cover your debt payments on top of normal living expenses can wreak havoc in both your personal and social life.

According to a study, adults in debt were three times more likely than those not in debt to have common mental disorders. Individuals facing growing debts are at much greater risk of experiencing anxiety or depression. The severity of the potential physical and mental health consequences of allowing your debt to pile up continuously should serve as a wake-up call about how proactive you need to be about paying it off. When you place debt resolution at the top of your list of priorities, you are proactively reducing sources of stress that can adversely affect your mental health.

Although paying off your debt isn’t an easy thing to accomplish, it’s worth your while because of all of the benefits that come along with dealing with it sooner rather than later. Don’t lose sight of the fact that your debt is an emergency situation!