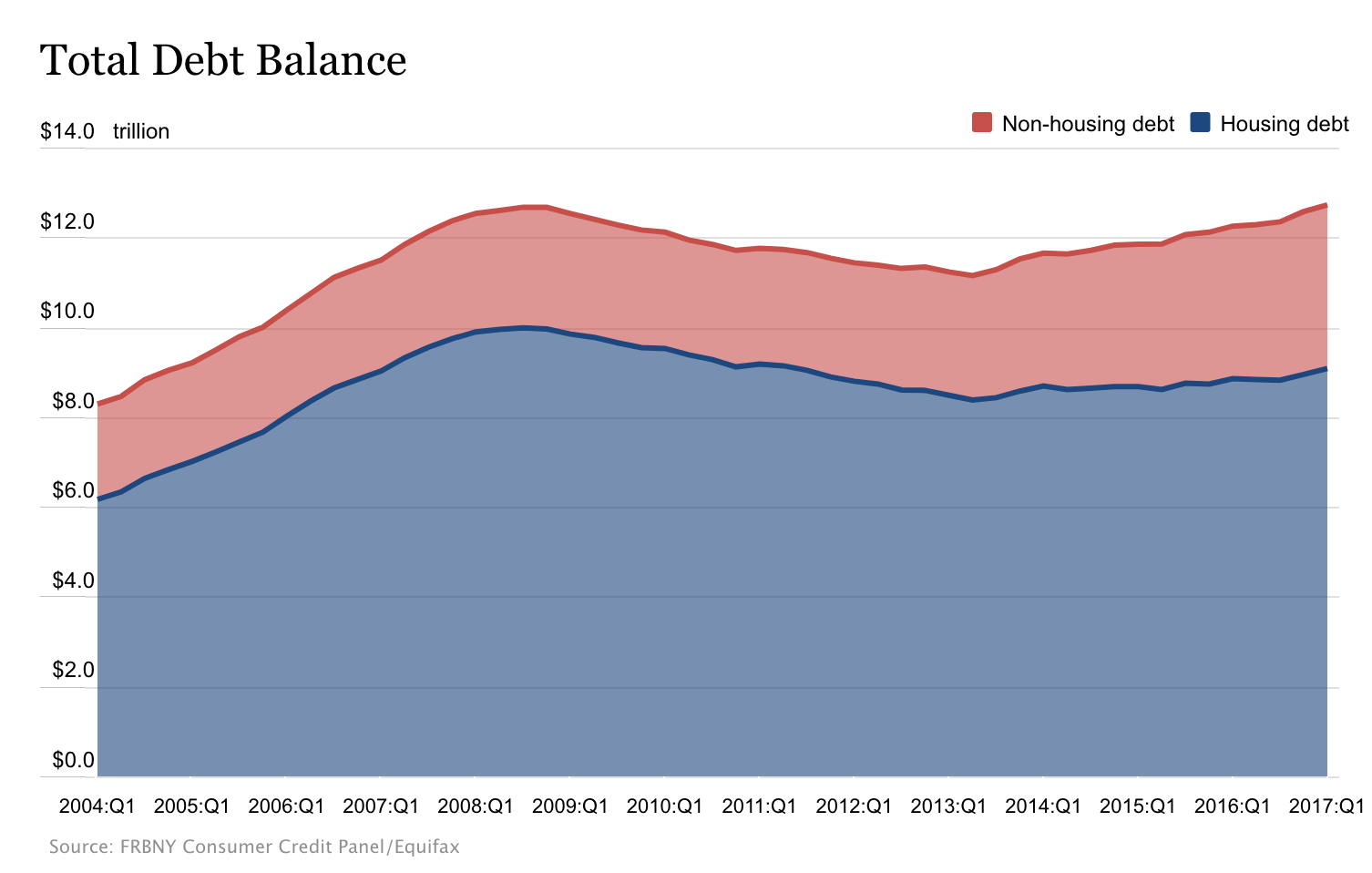

Total household debt reached an all-time high in the first quarter of 2017, according to a report by the Center for Microeconomic Data. At $12.73 trillion, it is $50 billion higher than the previous peak, which occurred during the financial crisis of 2008. With the economy starting to sputter back to life and banks easing their credit practices, more Americans have access to credit than ever before.

While the largest increase in household debt was in the home mortgage sector, credit cards, student loans, and auto loans still hold a large swathe of household debt, and this trend shows no sign of slowing down.

Reasons people fall into debt

There are many reasons consumers can find themselves struggling with a mountain of debt. Some of these reasons are self-imposed, while others are out of a consumer’s control. Many Americans have received little to no training or instruction on how to manage money or invest for their retirement. Since schools typically don’t teach these skills, many are on their own in figuring out how to budget and manage their finances.

Most consumers have very little money saved up to fund emergencies such as car repairs, necessary household expenses such as a roof or furnace, or a trip to the emergency room. Because of this, many consumers find themselves relying on credit cards and other high-interest credit sources to fund these emergencies. Sometimes, consumers fall into debt when something unexpected happens that they are financially unprepared for, such as the loss of a job or an illness. When this happens, things can deteriorate financially very quickly. Without the help of credit cards, many cannot get by.

Many times, consumers fall into debt due to overspending and living above their means. Many don’t realize the financial trouble they have gotten themselves into until it is too late. When they are no longer able to meet their obligations, the choices they have for debt resolution are few.

However, if a consumer recognizes the situation early enough, there are things the consumer can do to ease the burden and facilitate paying off debts. One of these solutions is a debt consolidation loan.

What is a debt consolidation loan?

A debt consolidation loan is a loan that bundles debt together into one loan with one payment. Usually, consumers aim to get a lower interest rate so that the new payment is lower than the sum of all of the current payments to creditors. Generally, the goal is to reduce the amount of money going out each month and streamline the payment process by only having to make one payment.

By reducing overhead and streamlining the payment process, many consumers feel that they have a clearer path to getting control of their debt and eventually paying it off. Often times, the term of the loan is longer and the interest rate is lower, so the new payment can be substantially lower than the current payments. With a clean slate, they feel they can finally get on top of the debt problem.

There are several types of debt consolidation loans for consumers to consider. The right choice is dependent upon individual circumstances, the loan size, and the consumer’s credit score.

For instance, someone who owns a home and owes substantially less than what it’s worth could qualify for a home equity line of credit (HELOC). Funds from a home equity line of credit are usable for anything the borrower chooses, so it is often the first place a consumer turns to when looking to consolidate debt. Home equity lines of credit can be easy to qualify for if a consumer has substantial equity, verifiable income, and a decent credit score.

Another type of loan utilized by consumers who own a home is a home refinance with cash out. This means the consumer borrows more than the previous mortgage and uses the extra money to pay off existing debt. Again, a consumer needs to have sufficient equity in his or her home, income that is verifiable, and a good to excellent credit score.

If a consumer’s debts are not too large, sometimes he or she can obtain a personal loan through a bank, finance company, or other lending institution. The interest rates are generally less than what they are on their current debt, but terms are short. These loans help people pay off debt quicker but don’t necessarily lower the total amount paid each month.

What are the pros of a debt consolidation loan?

A debt consolidation loan can very beneficial. You will have just one monthly payment to worry about, lessening the chances you miss a payment to a creditor. You will also likely face a lower interest rate and a lower monthly payment.

Just one payment

One of the best things about consolidating your debt is combining all your payments into one monthly payment. Being able to make just one payment per month reduces the chance of missed and late payments, which may help improve your credit score if this has been a problem in the past.

In addition, for those looking to reduce stress and streamline their lives, dealing with only one creditor is beneficial. Writing just one check or processing just one online payment can save a load of time and energy that you can then devote to family or life in general.

A lower payment

The goal of most debt consolidation loans is to achieve a lower payment through good terms and a lower interest rate. Done properly, a debt consolidation loan can make room in a budget for a family to save money rather than spending all the monthly income on bills and living paycheck to paycheck.

Possible lower interest rate

In order to make a good loan choice, consumers should make sure they understand the interest rates on their credit cards and other debt. They should assemble all their statements and make a complete list of balance amounts, interest rates, and any special terms such as introductory interest rates. This process is necessary to make sure they are actually consolidating their debt into a lower interest rate and making progress on paying down their debt.

If they have done their homework, they should come out with better terms and a lower payment overall.

Able to catch up on bills

If a consumer is chronically running behind and barely paying bills on time each month, a debt consolidation loan can help him or her catch up and maybe even get ahead enough to save each month. Families that struggle living paycheck to paycheck each month have a chance to catch their breath financially and take some pressure and stress off the financial aspects of their life.

If they are able to start saving money, their entire financial picture could begin to change. Instead of having to rely on credit cards to fund emergencies, they would have enough savings to pay cash. This would stop the cycle of accumulating debt when cash flow is insufficient.

What are the cons of a debt consolidation loan?

While there are advantages to consolidating debt through a debt consolidation loan, there are some potential downsides that every consumer should consider. These can have significant detrimental effects on a family’s financial picture.

Risk of running up credit card debt again

When consumers utilize a debt consolidation loan, they do not go through the long, painful process of paying off the debt and credit card accounts one by one. That painful alternative makes it unlikely that consumers will fall back into debt since they know, first hand, how hard it is to pay the accounts down and get themselves debt free.

However, if the process becomes easier with a debt consolidation loan, there is a chance that consumers who have not changed their habits and closed their credit card accounts could find themselves right back where they started. If they utilize a home equity line of credit or a home refinance to consolidate their debt, there is not just the possibility of accumulating more consumer debt, but also the possibility of ending up with a bigger mortgage. If the debts rise so high that they cannot meet their obligations, they could put their largest asset, their home, in jeopardy

Could pay more interest on a longer-term loan

Those who utilize home equity loans or cash-out refinance loans to pay off their credit card debt will most likely have a very long loan term. Most first mortgages have a 30-year term, and home equity loans are often very long as well. It would be wise to do some calculations to make sure the interest paid over the life of the loan doesn’t exceed what you would pay on a three-year payback.

Spending habits don’t change

Consumers who utilize a debt consolidation loan to handle their debt problem don’t learn the hard lessons of those who just put their nose to the grindstone and pay them off. Therefore, very little changes for consumers after the consolidation of debts. Often, the cash flow gained through the process gets quickly absorbed into daily living expenses, especially for those with poor budgeting and money management skills. Bottom line: if spending habits don’t change, it is likely that consumers could find themselves back under a heavy burden of debt in no time at all.

Other options

While debt consolidation can be a good option for some, those with shaky credit or poor money management skills will probably have a tough time qualifying. If this is the case, consumers have several options to consider.

DIY debt management

If a consumer is serious about paying off debt and has the self-discipline to cut spending and the dedication to stick to a plan, a few DIY methods are worth consideration. Do-it-yourself debt management is a tough road, but some consumers can be successful if they really put their minds to it.

One method is simply the three-year plan. On the front of every credit card statement is a box that shows how much you need to pay to eliminate the balance in three years. Simply close the account and set up automatic payments each month. In 36 months, you will be debt free.

The other method of DIY debt management is the “snowball” method. This involves starting with the lowest balance and paying as much as possible each month while continuing to pay the minimum on all other accounts. Once the lowest balance is at $0, attack the next highest balance in the same manner. As time goes by, balances will fall by the wayside as the payments “snowball” and get bigger and bigger.

Work with a debt relief company

Those who are unable to make headway with their debt and are perilously close to not being able to meet their obligations may want to consider working with a debt relief company. Companies such as National Debt Relief work with consumers to settle their debts with creditors, sometimes for pennies on the dollar. Moreover, the stress of creditors calling and demanding payment goes away, as the debt relief company takes over all communications. While a consumer’s credit score will most likely take a hit, it was probably not in great shape, to begin with, and the damage certainly will not be as long-lasting as a bankruptcy.

Tackling overwhelming debt can be a difficult process for any consumer. However, the most important thing to remember is to act before your options become too limited. Take charge of your debt today and get on the path to being debt free.